There’s continually discussion around how to speed up the conveyancing process. Buyers and sellers want to move faster, and those expectations are projected onto conveyancers. One way to help manage these pressures is through the adoption of digital conveyancing. But, when different law firms are adopting tech at different rates, it can make it difficult to move the whole industry forward. That’s where mandates come into play.

We let our panel of industry experts debate whether digital conveyancing should be mandatory at the Digital Conveyancing Summit recently. If you missed it, catch up now on-demand. The overwhelming consensus on the matter was yes, mandates will be required if we’re to reach a truly digitised conveyancing process. So, let’s look a little deeper into why digital mandates might just be what the industry needs and how conveyancers can benefit.

Why digital mandates are good for expediting progress

The reality is we are now living in a digital world. We're banking online, ordering food and shopping with the click of a button, and manage just about every part of our daily lives from digital devices. Why should conveyancing be any different?

With the rest of the world shifting to digital, consumer expectations are shifting too. People want to be updated automatically via apps and notifications. They want to complete forms and checks online because no one has printers these days. They don’t want to head into their local law firm, and they want to do everything at a time that is convenient for them. This means that their expectations around the home moving process will align with their other digital experiences. The reality is, not all firms are offering that yet.

What we’re currently seeing is more choice in the market. There are increasingly more digitised services available and a variety of providers offering those tools. There’s no longer a limitation around accessibility to technology because, as we’ve seen in the Digital Conveyancing Maturity Index, small firms are remaining competitive by adopting technology.

So, there really stands no barrier to an end-to-end digital conveyancing process, or is there? The thing is, the legal industry is notoriously cautious about adopting technology. Caution once seemed wise while digitisation was still new – a case of letting the early adopters conduct trial and error, watching, and learning. However, we’re well into an era where there are tried, tested, and trusted solutions available.

Digital mandates will bring greater alignment to the sector, ensuring firms are all working towards the same objectives for the industry – fast, secure, and sophisticated digital conveyancing from start to finish. Without them, some firms will continue to lag behind while others are quick to jump at the opportunity to adopt the next tool.

If we’re to get everyone on the same page about digital conveyancing, mandates will help us get there sooner.

What are the challenges of mandating digital conveyancing?

Of course, no change comes without a little challenge. But it’s almost always for the best long term. To paint a rosy picture without the realities of this transition wouldn’t be fair. As far as challenges go, they generally cover three areas; who will enforce the mandates, which processes or tasks are mandated, and what about complex transactions and exceptions?

One of the other key problems is that conveyancers aren’t sure when it is okay to accept digital and when it isn’t. By having mandates in place, it will give law firms the green light on which technology solutions are accepted and safe to move forward with. Without mandates, it’s going to take a much longer journey to ensure everyone is adopting digital tools in conveyancing confidently.

Should we mandate all digital conveyancing processes, or just some?

During the debate, some of our panellists suggested that digital mandates should be introduced to get the entire conveyancing sector onboard and aligned. They also suggested that a timeframe to complete a transaction be stipulated to ensure everyone works toward it – sharing the onus of speeding up transaction times.

A fair point too was raised about how exceptions and complicated transactions are treated. If we have 100-year-old handwritten deeds, how are we tackling that in the digital space? As Nick Chadbourne, CEO of LMS commented:

“You can't design software or technology for the exceptions. You've got to design software and technology for the mass”.

He also went on to point out that you don’t just digitise part of the process; you digitise it all because different parties will adopt different parts on different timescales. Some areas though would be faster and easier to mandate than others.

eSignatures are one area that would be quicker to mandate. HMLR have been accepting them on witnessed deeds for over two years and they have plans for the use of qualified electronic signatures in the future. Lenders, such as Nationwide, have also recently begun accepting digital signatures in the conveyancing process because they see the value of it. This would be one area that is quicker to mandate because the blueprint is already there.

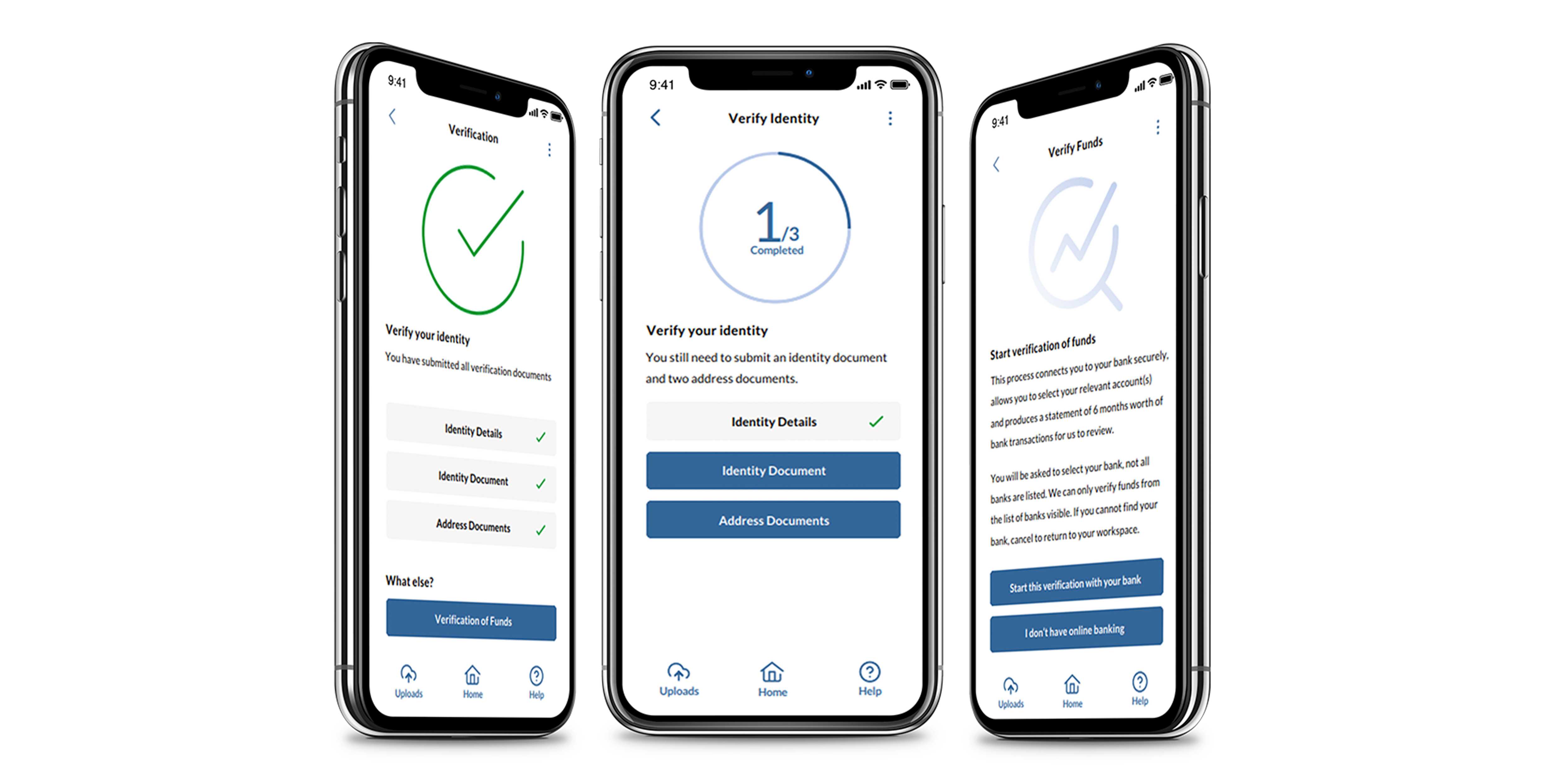

Another area is digital ID verification. The government is currently in its beta version of the UK Digital Identity and Attributes Trust Framework which shows a concerted effort toward digitised IDs. HMLR also launched the Digital Identity Standard in March 2021 which provides Safe Harbour for law firms provided they meet the criteria for conducting digital ID verification.

So, while a single overarching digital mandate wouldn’t be a reality, focusing on specific parts of the process and moving them over to digital to begin with has a lot going for it.

How digital conveyancing mandates will improve the process for conveyancers

The big question in all of this though is, will law firms be better off if digital conveyancing mandates are introduced? In short, yes. Here are just a few ways law firms will be better off under mandated schemes for the digitisation of conveyancing.

Trusted digital ID framework

Currently, several parties need to verify the clients’ ID. Estate agents, lenders, conveyancers – they all need to confirm their client is who they say they are. The use of digital IDs as outlined in the UK Digital Identity and Attributes Trust Framework would make this process smoother. By creating one authorised digital ID, the client can easily distribute it to all parties who require a copy.

With ID verification taking place at the start of the transaction, not having to go through the rigmarole of individual ID checks with every party will save time from the outset. While this isn’t yet available, law firms can still use digital onboarding tools in their process now. They’re more secure, speed up the return of key onboarding information, support compliance efforts, and helps law firms meet client expectations.

Standardised processes mean greater consistency

There is always a risk that law firms will choose a different digital solution which can mean incompatibility that doesn’t really alleviate some of the pain points in the process. Instead, if mandates are introduced, it will create standardisation within the industry and ensures all parties are moving forward together.

A great example of this can be seen with Digital AP1s. Not only aimed at reducing requisitions which will in turn speed up the process, digital AP1s have ensured that technology providers must meet certain criteria to provide the service. This results in the elimination of a monopoly, giving law firms a choice of provider, while ensuring they meet the requirements set out by HMLR.

Standardisation would also give conveyancers peace of mind that there are approved or accepted digital processes so they can move forward with confidence they are meeting their compliance requirements.

Faster transactions

Speed is a big factor in the debate around digital mandates. Most parties want to see property transaction times reduced, so working together to find solutions that support that objective is in everyone’s best interest. Both points outlined above would help with improving transaction times.

In the simplest view, removing paper and post from the process cuts out obvious time losses and digitising processes means firms already have access to those benefits. There is also the argument for unique property reference numbers and property logbooks. This would mean all information about a property could be digitised, including a deeds packet, so the information is available and ready when required – no more hassle of digging out the details.

Who would enforce digital conveyancing mandates?

Evidence would suggest that there are two main parties that are best suited to instil digital conveyancing mandates; the government or lenders. We’re already seeing the early stages of this with the digital AP1 mandate from HM Land Registry. And while not yet mandated, we are seeing both HMLR and lenders driving the digital conveyancing agenda forward with the acceptance of eSignatures.

While we haven’t seen a string of digital conveyancing mandates launched by HMLR yet, they clearly have a vision for a digital future for the home moving process, as outlined their new three-year business plan. Does this mean there are more digital mandates set to come in the next few years? Possibly.

As for lenders, they sit in a position of power when it comes to being a voice for mandates. A lot of what can and can’t happen related to a property involves the lender, because there’s risk mitigation and specific lending requirements in place. We’re currently seeing a lot of volatility in the market due to the current economic climate, so they are focused on managing a lot of that risk.

Much like lenders now recognising eSignatures, they too could stipulate other processes to be digitised – much because of the added security and assurance technology adds, from ID verification to Open Banking and more.

Whether digital mandates do become more common in the conveyancing process, it’s clear that certain parties have influence which could turn the tides on the adoption of digitals now, rather than in five years' time.

About the author

Digital Conveyancing Summit

The Digital Conveyancing Summit provides conveyancers with a hub of leading-edge sector knowledge all packed in informative and comprehensive articles and interviews, offering guidance, best practice and food for thought around how technology can help us work smarter.